- Chat-TMT

- Posts

- $7 Trillion in New Semiconductor Fabs

$7 Trillion in New Semiconductor Fabs

Altman Wants to Change the Industry

Investing insights in AI, Quantum Computing, and the evolving TMT landscape.

Earnings Highlights

Cadence Design Systems (CDNS) reported slightly better than consensus expectations but forecast March below expectations, sending the price lower in after hours trading last night. Cadence offers a software as a service (SAAS) platform for semiconductor engineering and design, and was expected to benefit from the growing push for AI chips and associated semiconductor hardware to support the growing technology. Revenue for the December quarter was $1.07 billion vs. consensus of $1.06 billion and EPS was $1.38 vs. consensus expectations of $1.33. Guidance for March was lower than expected, however, with management stating that it expects revenue to be approximately $1.0 billion at the mid-point, lower than current consensus of $1.09 billion.

Despite the lower than expected March guidance, management stated that it was experiencing secular growth in hyper-scale computing and autonomous driving, driven by “an AI super cycle.” The company is currently working with most, if not all, of the major AI winners including Nvidia, Intel, Arm, Samsung, etc., and it is possible that the company is sand-bagging its forward guidance a bit given the higher forward expectations we’ve seen across the group in recent weeks. Backlog reached a record $6.0 billion in December, and cash flow for the quarter was $272 million, $1.35 billion for full-year 2023.

Net-net, it appears that the stock may experience weakness given the lower than expected guidance, but this will most likely mark a buying opportunity as the company will benefit from the AI “super cycle” as it serves most of the top companies making chips for the technology. Management mentioned that they prefer to beat expectations, so it seems that they have just set the stage to make it a bit easier to accomplish that task for the remainder of 2024.

Lattice Semiconductor (LSCC), a maker or programmable power products for the communications, computing, industrial, automotive and consumer markets reported results more-or-less in-line with Street expectations last night, but guidance was disappointing. For December, the company reported revenue of $170.6 million and EPS of $0.45 vs. consensus expectations of $176.0 million and $0.45. For March, management guided revenue to $140 million at the mid-point, well below consensus estimates of $175 million.

Management stated that the industrial and automotive markets are experiencing weakness, and were down 9% Q/Q in December despite being up 11% Y/Y in the quarter. Additionally, Lattice experienced weakness in its communications and computing business, down 14% Q/Q in December, driven by lower wireless infrastructure deployments. Management expects March weakness to be driven by the consumer end market as inventory levels are reduced, with revenue expected to rebound in the second half of CY24. The rebound should be driven by the ramp of the Company’s new Lattice Nexus and Avant product ramps. It may be best to look for other opportunities until the second half of the year barring a significant pullback in the stock.

Upcoming Reports - Over the next two days there will be a large number of companies reporting as shown in our earnings calendar below. We expect that AI theme to continue, with most companies trying to showcase how they are involved in the emerging technology.

In Other News

Sam Altman, the CEO of OpenAI and ChatGPT, is trying to reshape the semiconductor industry by convincing investors to spend $5-$7 trillion to drive new fabs and new technologies that would reduce the costs and increase the accessibility of the high-powered chips needed to power generative AI, and eventually, artificial general intelligence. Mr. Altman points to the scarcity of the graphics-processing units (GPU’s) made by industry leader NVidia and its challengers including AMD, Intel and others. But there are other bottlenecks along the supply chain including the advance packaging required for AI chips and a myriad of highly specialized components and systems that power the data centers where these powerful AI systems reside.

While semiconductor chipmaking advances will eventually catch-up to the overwhelming demand that currently characterizes the market for AI components, we are at the very early stages of the roll-out for AI systems. There are few companies that can foot the bill to develop new fabrication facilities to develop advanced chips. Currently, the list includes TSMC, Intel and Samsung. China has spent over $150 billion over the past several years to try to catch-up, but has not been successful. Europe has recently earmarked billion to stay relevant after the US announced its $52 billion Chips Act that plans to invest close to $40 billion on new fabs. But Mr. Altman wants to spend significantly more than the rest of the world combined. In fact, he wants to spend about 10 times more than the entire semiconductor sector made in revenue last year, or about $527 billion, according to industry estimates. (SEMI)

Gartner released its AI-assisted smartphone and PC shipment expectations last week, along with expected growth in both markets after more challenging recent results in both PCs and smartphones. It expects the PC market to be up 3.5% in CY24 and smartphones to grow 4.2%, both driven by growth in AI-assisted offerings: Gartner

AI is coming for white collar workers - the latest in terror-inducing articles involving AI comes from the Wall Street Journal which sounds the warning bells for those higher up the corporate ladder. Experts predict this powerful technology, capable of creative tasks and idea generation, will significantly impact knowledge work across various industries. Unlike past automation, it might not just accelerate routine tasks but potentially replace them and even managerial roles altogether. The corporate ladder across all industries may see significant reshaping due to this rapidly evolving technology. Wall Street Journal

Journalist Lila MacLellan of MSN suggest that one sign that AI will take your job involves, counterintuitively, a higher wage. “Anxious workers concerned that generative AI and sophisticated robots will one day endanger their job of choice should watch for a counterintuitive sign: rising wages.” “researchers found that when it’s commonly believed that a particular job category soon won’t exist, that field begins shedding employees. Some people make the jump to other professions, and predictably, fewer workers enter the doomed job category. That leads to a supply crunch for employers, who are in turn required to pay a premium—or what the study authors dub an “obsolescence rent”—to the role’s holdouts.”

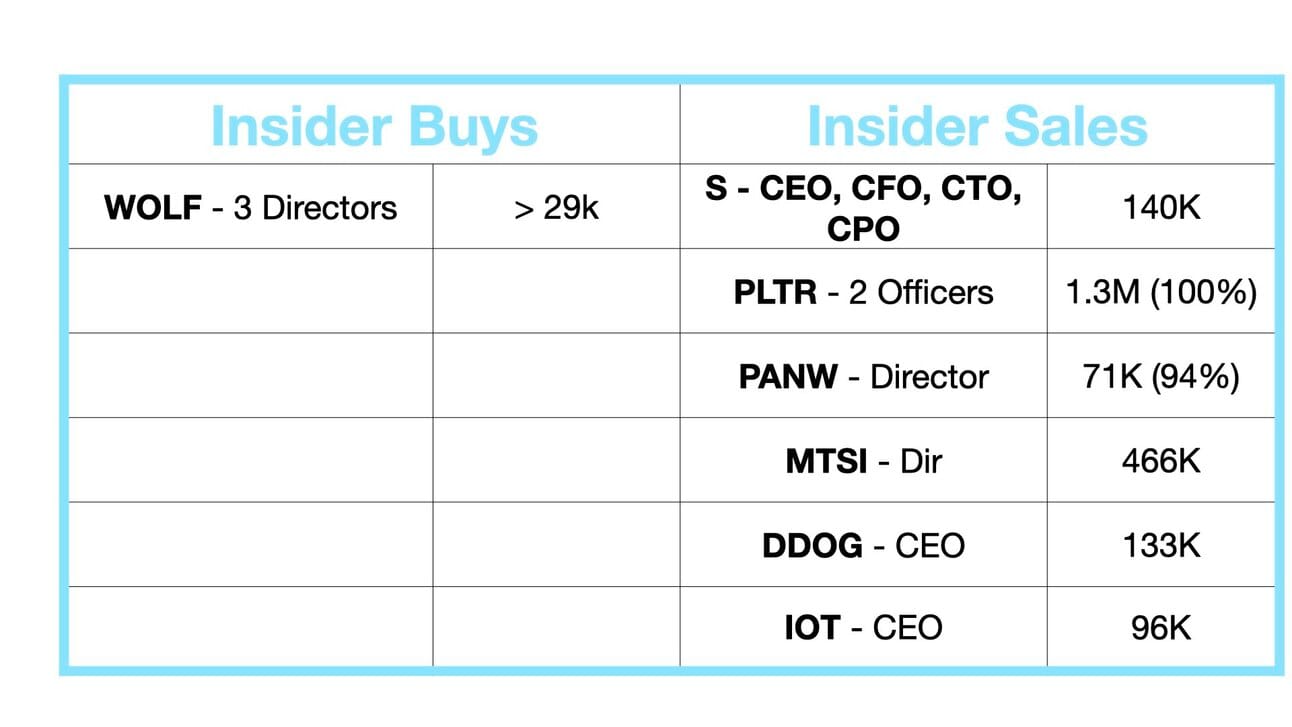

Insider Activity

One PLTR executve sold 100% of his position and a director of PANW sold 94% of his position. It could mean both are retiring or moving onto greener pastures - but it’s worth asking the companies about the respective reasoning.

Chart of the Day

Source: Thinkorswim

AAOI has been ripping higher for over a year, up of 13X from a low of $1.60 in 2023. While it is clear that there is significant anticipation ahead of its earnings report on February 22nd, 2024 - the company is well positioned to benefit from the strength that has sent many other stocks flying over the past couple of weeks.

Over the past three years, AAOI has struggled in the data center, with revenue in the segment dropping from $173 million to $77 million in 2022 and from 74% to 35% of revenue in the same time period. For the first nine months of CY23, revenue in the data center business was nearly $97 million. much of which was driven by the growth in AI, particularly at its largest data center customer, Microsoft. Given the strong MSFT report and outlook, it is likely that AAOI will continue to experience significant growth in its data center business in CY24, which will most likely help the company return to profitability.

Despite the huge stock move in 2023, there is nothing fundamental that will likely stand in AAOI’s way in 2024, so it has plenty of opportunity to push past its recent high of $24.08 barring a massive change in the overall market outlook.

Earnings Calendar