- Chat-TMT

- Posts

- Building LLMs Without Your Permission

Building LLMs Without Your Permission

The FTC Wants to Protect American Data

Investing insights in AI, Quantum Computing, and the evolving TMT landscape.

Earnings Highlights

Informatica (INFA), a leader in enterprise cloud data management, reported revenue for the December quarter of $445.2 million, above consensus estimates of $432.2 million. $7 million was from foreign currency gains, but the company managed to eke out a consensus beat after adjusting the top-line for the gain, with a small beat of 1.4%. EPS was $0.21, well below consensus estimates of $0.30, however; driven in part by the restructuring announced in late 2023 and updated in January, 2024.

Highlights from the call:

Expanded partnerships with Microsoft and Amazon Web Services

Expanded partnerships with Snowflake and Databricks

Started new strategic partnership with MongoDB with INFA’s Master Data Management (MDM) SaaS solution

Shifted from perpetual license and maintenance model to subscription-based, cloud only, consumption driven model

Introduced CLAIRE generative AI and copilot

Looking ahead, management is guiding March revenue to $385.0 million at the mid-point, roughly in-line with current consensus of $388.7 million. For calendar 2024, management is guiding revenue to $1.695 billion at the mid-point, a bit above current consensus estimates of $1.68 billion.

Pegasystems (PEGA), a provider of an enterprise workflow automation and AI decisioning platform reported strong results for the December quarter and CY23. Revenue for the quarter was $474.2 million, up nearly 15% above consensus estimates of $413.6 million. Earnings per share were well above consensus as well at $1.61 vs. estimates of $1.00. In CY23, the company increased the annualized contract value (ACV) of its customer 11% to $1.3 billion, increased its operating cash flow from $22 million in CY22 to $218 million, and improved its free cash flow from a loss of ($13.0) million in CY22 to a $201 million in CY23, an all-around stellar improvement. Backlog is currently up 8% year-over-year, suggesting further top-line and operational performance gains in CY24. Pega is experiencing growth across all of its business lines with the exception of consulting services, with cloud up 32% Y/Y and Subscriptions up 84%.

Management provided full year 2024 guidance of $1.5 billion and $2.75 in EPS, $365 million in cash from operations and free cash flow of $350 million, suggesting another banner year, with a target of sales and profit margin growth in the 40% range.

Veeco Instruments (VECO), a leading maker of semiconductor capital equipment, topped analysts expectations for the December quarter, reporting revenue of $173.9 million vs. an expected $169.4 million, and EPS of $0.51 per share vs. $0.42. The company is benefitting from the introduction of two new products including its Nanosecond Annealing solution and its new Ion Beam Deposition System, both of which allow customers to make devices with higher performance and lower power consumption. It also experienced strength from its annealing systems for DRAM and logic devices. VECO is benefitting from shrinking geometries which require precise annealing and from the creation of GPUs and HBM DRAM that are used in artificial intelligence systems.

The company expects its semiconductor segment and compound semiconductor segment will be up 5-10% in CY24, and its data storage segment to be flat to up 10%. It has shipped two evaluation systems for silicon carbide (SiC) and plans to ship a gallium nitride (GaN) evaluation system in 2024. For the March quarter, management guided to a revenue range of $160-$180 million, in-line with analyst’ consensus of $172.2 million and non-GAAP EPS in a range of $0.36-$0.46, in-line with current consensus of $0.41.

The net takeaway is another solid quarter from Veeco with in-line guidance. The company has several irons in the fire in terms of new products and should benefit from the AI mania that is taking hold given its leading annealing systems and from its new SiC and GaN products that target power semiconductors used in everything from consumer devices to electric vehicles.

Chart of the Day

While the chart doesn’t look that appetizing, PEGA is sitting at roughly 33% of its 5-year high of $148.8. While it still has a number of issues to contend with, an earnings beat of 60%+ will likely be rewarded, particularly with strong forward revenue and earnings guidance. There is little resistance until $80.00 on this one, so it could see some significant lift after the report last night.

Industry News

Arm, Soundhound AI shares jump as Nvidia builds stake - Link

AI is driving a bigger smartphone upgrade cycle - Link

New era of deepfakes complicates the 2024 elections - Link

Slack rolls out generative AI search and summary - Link

AI drives Taiwan stock index to record high - Link

FTC warns against using Americans’ data to train AI without permission - Link

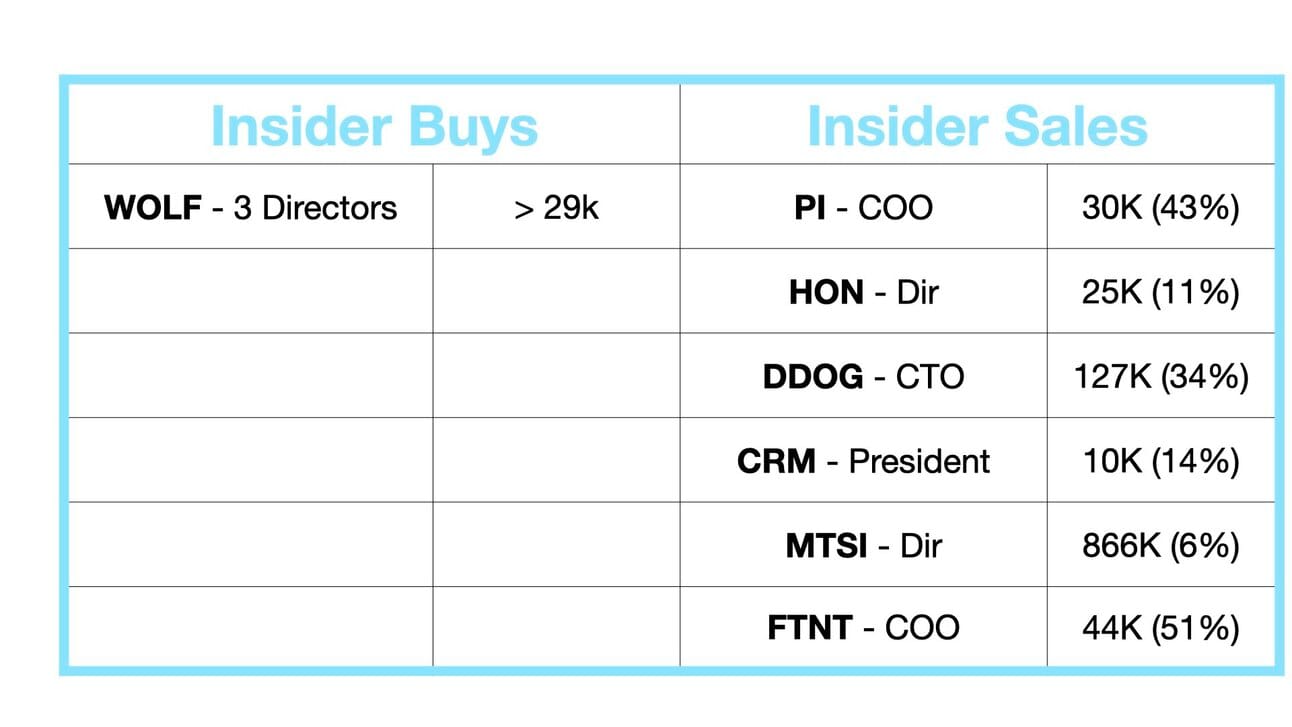

Insider Activity

There are a few sales of note today including the COO of Impinj, who sold 43% of his stock; the CTO of Datadog, who sold 35% of his position; and the COO of Fortinet, who sold over half of his stake in the company. Either all three are leaving their respective companies, or they all think the market is getting a bit too ahead of itself and are cashing in while they can. In any event, all of these sales send up warning flags.

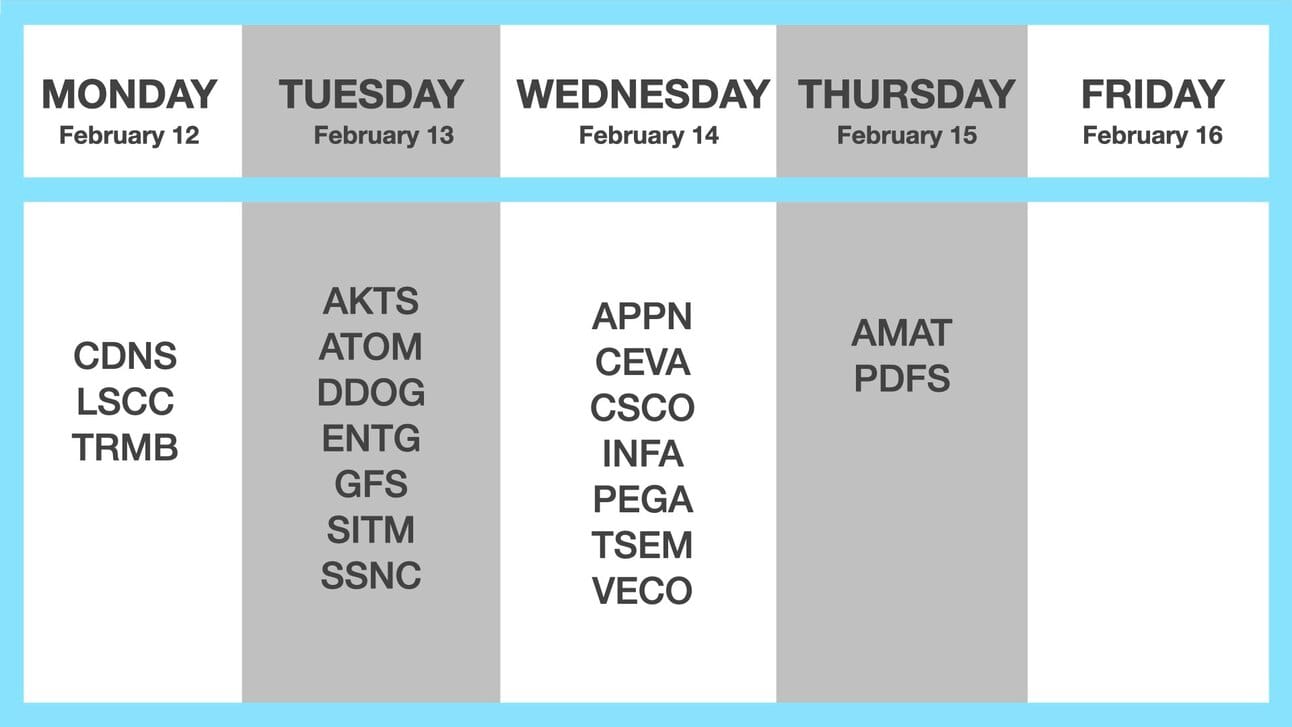

Earnings Calendar