- Chat-TMT

- Posts

- Everyone Can't Win All the Time

Everyone Can't Win All the Time

Weak Guidance Despite AI Exposure

Investing insights in AI, Quantum Computing, and the evolving TMT landscape.

Earnings Highlights

Applied Optoelectronics (AAOI) reported mixed results during the December quarter, and delivered a massive cut to guidance for the March quarter. AAOI reported lower revenue in the December quarter of $60.5 million vs. an expected $65.2 million but positive earnings per share of $0.04 vs. an expected loss of ($0.02) driven by substantially higher gross margins of 36.4%, up from 32.5% in the prior quarter and 21.4% in the prior year.

For the March quarter, management is guiding substantially lower to revenue of $43.5 at the mid-point vs. the current consensus estimate of $66.2 million, a drop of nearly 35%., with a loss per share of ($0.28) vs. the expected ($0.01).

Management cited weakness in its data center business as the primary driver of the reduced revenue in December and for the weak outlook. Going forward, it is experiencing price reductions in March, but management expects that it will see a stronger second half of the year driven by 400G and 800G products at several new data center customers, at least one of which is expected to ramp in the June quarter. Management is still guiding to full year non-GAAP profitability despite the significant March quarter haircut, but it doesn’t appear that investors have much confidence in that story pre-market, with the stock indicated down nearly 41%.

A major bright spot for the company involves, you guessed it, AI. Specifically highlighted was the company’s relationship with Microsoft, which signed two agreements with AAOI to develop a next-generation laser for the data center and for the development of active optical cables. Management expects that the new Microsoft agreement could lead to over $300 million in revenue over three years. Revenue from 200G and 400G products were up nearly 80% Q/Q in December, and management does expect this segment to grow significantly in the second half of CY24.

Today is going to be painful given the significant drop in expected revenue for the March quarter, but AAOI should be kept on the radar for a significant rebound in the second half of the year given its exposure to the AI data center and fiber markets.

Altair Engineering (ALTR), a provider of computational intelligence software for high-performance computing, data analytics and AI, reported December revenue of $171.5 million, just shy of analyst consensus of $172.7 million. Non-GAAP EPS was $0.46, above consensus of $0.41 for the quarter, driven by higher margins.

For March, management is guiding to revenue of $168.5 million, more than 7% lower than current consensus of $181.7 million.

AXT, Inc (AXTI) is a small cap materials science company that provides semiconductor substrate wafers using indium phosphide (InP), gallium arsenide (GaAs) and silicon germanium (Ge). The company sells its wafers for use in multiple markets including 5G mobile phones and infrastructure, data center connectivity, optical networks, among others, and is often tracked by Wall Street analysts for insight into broader trends. The company handily beat the December consensus revenue estimate, reporting $20.4 million vs. $17.6 million, however, it was still down more than 23% year-over-year. . Non-GAAP gross margins improved to 23.2% of revenue, up from 11.3% in the prior quarter but still lower than the 32.5% reported during December of last year, which led to a lower loss per share of ($0.07) vs. analyst’ consensus of ($0.15).

CEO Morris Young stated that he believes the company is “now beginning to see recovery” in its markets. Highlights include stronger demand for indium phosphide driven by power, fiber optic and artificial intelligence, as well as greater demand for gallium arsenide as smartphone channel inventory appears to be clearing. The company is positioned to benefit from the growth in artificial intelligence as 800 gig speeds and beyond will drive a shift from VCSELs to indium phosphide, greatly expanding its total addressable market.

For March, management is guiding revenue above current analyst expectations to $20.00 - $22.00 million from current consensus of $18.0 million with a loss of ($0.06) - ($0.08) vs. the current expectation of ($0.12). It is possible that AXTI will reach profitability in the second half of calendar 2024, which makes this a potential turn-around play, driven by higher speed networking in the data center and infrastructure markets for AI applications.

Indie Semiconductor (INDI), a growing provider of automotive semiconductors and software, reported revenue of $70.1 million in the December quarter, up 112% Y/Y and 16% Q/Q but lower than consensus estimates of $72.6 million. Non-GAAP EPS was in-line with consensus at ($0.01), as the company continues its March towards profitability. Given the weak state of the automotive market, management is doing a decent job of managing through, growing revenue despite the slowdown in auto sales driven by higher interest rates and higher prices.

For March, management is guiding to a sequential drop of 20% on the top line to $56.08 million, substantially below current analyst expectations of $56.1 million. The company believes that revenue growth will resume in June, and be stronger in the second half of the year, with profitability now pushed out towards the end of calendar 2024. While the guidance is disappointing, it is not altogether unexpected given what we’ve learned from other companies that sell into the automotive market. INDI has been growing faster than its market, and will likely bounce back once the automotive market improves. (Full disclosure, the author owns shares of INDI.)

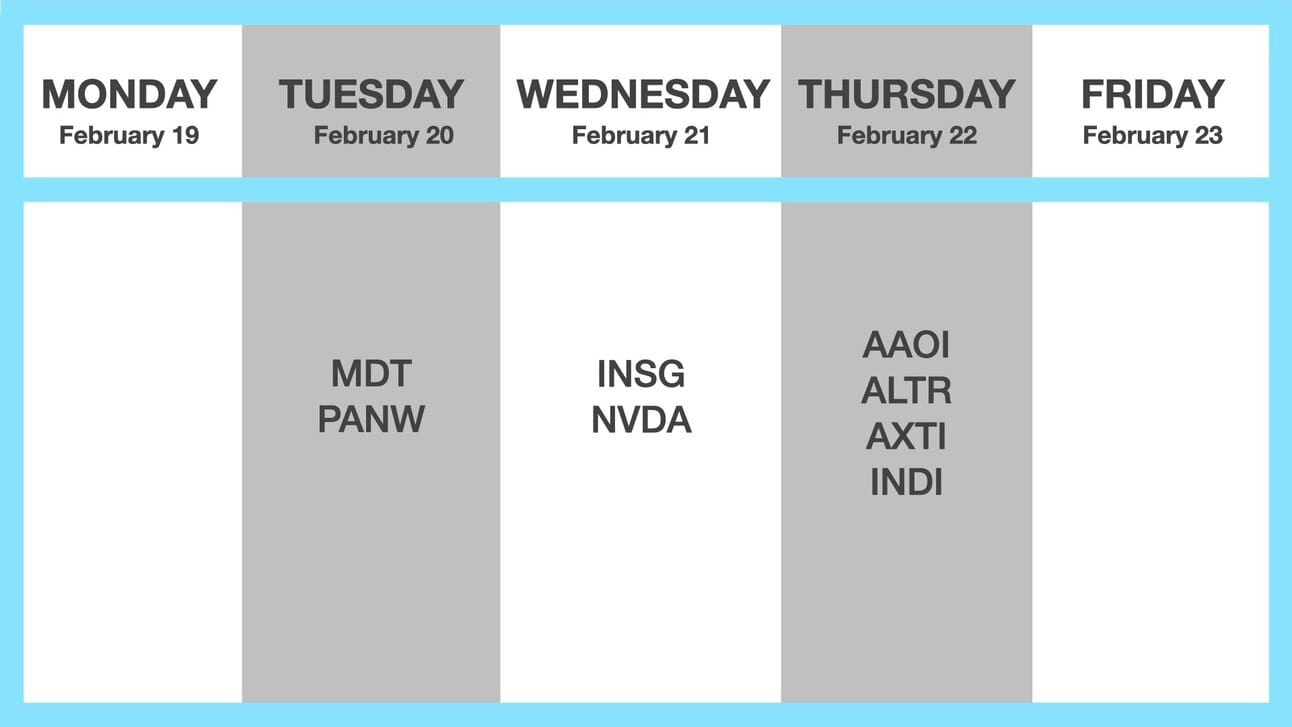

Earnings Calendar