- Chat-TMT

- Posts

- NVDA Keeps the Party Going

NVDA Keeps the Party Going

AI Is Just Getting Started

Investing insights in AI, Quantum Computing, and the evolving TMT landscape.

Earnings Highlights

Nvidia (NVDA) reported number that should keep the AI party going last night, driving the stock over 14% higher in pre-market trading this morning. This is great news across the board for AI stocks, and the broader market as a whole, as investors will likely remain jazzed about Nvidia’s outlook.

The company beat analyst’ consensus for the January quarter, reporting revenue of $22.1 billion, up 22% sequentially and up $265% Y/Y. Analysts were modeling revenue of $20.6 billion for the quarter. Earnings per share for January was $5.16, more that 11% higher than consensus estimate of $4.63 and significantly higher than the $0.81 reported last January. NVDA’s quarter shows that the AI theme is real and here to stay, with the company in the drivers’ seat.

The performance was driven by data center revenue, which more than tripled from last year from growth in training and inference of generative AI and large language models (LLMs). Over half of the data center revenue came from large cloud providers including Google, Microsoft and Meta. Revenue grew across all geographies except China, where US export controls led to a significant year-over-year drop. Management stated that current demand still exceeds their production capability, as its products have become the defect standard for AI infrastructure and accelerated computing.

For the April quarter, the company is guiding revenue to $24.0 billion at the mid-point, up from current analyst’ consensus of $22.2 billion, with Data Center and Pro Viz up sequentially, partially offset by a seasonal decline in gaming revenue. Management expect that the growth will continue for the next two years at least, given its significant lead in accelerated computing and the strong demand across multiple industries driven by generative AI and inferencing, which has grown to over 40% of Nvidia’s revenue. Growth will be further driven by other nations wanting to replicate their own LLMs and AI platforms that have driven AI growth over the past year in the US in their own languages and products, so we are at the beginning of a worldwide growth trend.

The net result for NVDA and AI in general is that there is no sign of the market slowing down, which should be good for both Nvidia’s stock and the wider group as a whole after the report and conference call last night. NVDA can’t keep up with demand for its products, and is gearing up to introduce several newer, faster offerings in 2024 that should see growth continue for the foreseeable future.

Inseego (INSG) reported better than expected results last night, and simultaneously reported that its CEO, Ashish Sharma, is stepping down. Inseego is an under-followed company that provides enterprise wide-area-networking (WAN) solutions. Philip Brace, a board member for the past six months, is in a temporary new role as Executive Chairman of the Board, and will take the reins until a new CEO can be found.

For December, the company reported revenue of $42.8 million, above the $40.6 million expected by analysts but EPS was significantly lower at a loss of ($1.28) vs. an expected ($0.48). Adjusted EBITDA was $4.1 million, however, higher than expected. For March, management is guiding in-line with analyst expectations, with revenue of $41.0 million, with current consensus at $40.6 million and adjusted EBITDA in the range of $2.0-$2.5 million.

INSG has returned to positive cash flow, which could be a signal that the company has hit bottom, finally. Combined with the move to shift the management team by seeking a new CEO, this could be a decent entry point for the stock, for a rebound play if nothing else. It remains extremely risky, however, as the debt burden on the company is still quite higher, with nearly $160.0 million in debt and only $7.5 million in cash on the balance sheet. Management made a decent case on the call that they are more focused on driving revenue growth and providing positive cash flow moving forward, so this could be an interesting inflection point.

In Other News

Intel attempted to steal a bit of Nvidia’s thunder today with the launch of its new system foundry “designed for the AI era.” The launch, at Intel’s first foundry event, Intel Foundry Direct connect, was complete with a star-studded roster of partners and government muckety-mucks. The goal of the event was to highlight Intel’s push to compete with Taiwan Semiconductor in the making of chips for other manufacturers at its growing portfolio of fabrication facilities in the United States and abroad.

One of the biggest announcements was delivered by Satya Nadella of Microsoft, who stated Microsoft plans to produce a design on the Intel 18A (1.8nm) process. Intel also reaffirmed that its five-nodes-in-four-years (5N4Y) process roadmap remains on track for delivery, with the 18A process to enter production in calendar 2025, swiftly followed by the 14A process. To put this in comparison, TSMC is still developing 2nm and 3nm process nodes “continue progressing through the development pipeline,” with 3nm expected to enter production in the current year. The key point here is that Intel, lagging behind TSMC and Samsung in terms of process node leadership, expects to regain process leadership with 18A, and to deliver a new node every two years thereafter. Additionally, the company plans to introduce its new Intel 3 advanced packaging technologies, concurrent with 18A, that will deliver backside power solutions. And finally, Intel unveiled its “Emerging Business Initiative” in collaboration with ARM Holdings, that will support emerging semiconductor start-ups with manufacturing support and financial assistance for the development of ARM-based solutions built in Intel’s foundries.

Source: Intel

US Commerce Secretary Gina Raimondo was at the event, and stated that she believes there should be a second CHIPS Act, as the first $52 billion that is just beginning to be distributed is not enough to help the US regain its global lead in semiconductors. Many believe that Intel is about to receive approximately $10 billion from the CHIPS Act, and would be in line for additional funding if Congress pushes through a second round of financing.

We highlighted Intel as our Chart-of-the-Day on January 6th, 2024 (article), and believe the company is setting itself up for a significant rebound over the next few years driven by AI and Intel’s new foundry business. Global uncertainty, specifically with the tense China/Taiwan brinksmanship, could present Intel with customers looking to diversify risk away from the current foundry leader.

Source: Adobe

Adobe introduced a new AI assistant in beta for Acrobat and Reader. The assistant uses generative AI to allow users to generate summaries and insights from long documents and to format those summaries for distribution through mediums including e-mails, reports, presentations, text, etc. Subscribers of Individual, Pro and Teams plans can use the beta right now, with new features coming over the next several days and weeks. The new assistant will offer the following:

AI Assistant: AI Assistant recommends questions based on a PDF’s content and answers questions about what’s in the document – through a conversational interface.

Generative summary: Get a quick understanding of the content inside long documents with short overviews in easy-to-read formats.

Intelligent citations: Adobe’s custom attribution engine and proprietary AI generate citations so customers can verify the source of AI Assistant’s answers.

Easy navigation: Clickable links help customers find what they need in long documents.

Formatted output: Ask AI Assistant to consolidate and format information into top takeaways, text for emails, presentations, reports and more. A "copy" button makes it easy to cut, paste and pass along.

Respect for customer data: AI Assistant features in Reader and Acrobat are governed by data security protocols and no customer document content is stored or used for training AI Assistant without their consent.

Beyond PDF: Customers can use AI Assistant with all kinds of document formats (Word, PowerPoint, meeting transcripts, etc.)

The three day Advantage DoD 2024:Defense Data and AI Symposium kicked off today, led by the Pentagon’s top artificial intelligence official, Craig Martell. The Symposium is being held to help lay out the Department of Defense’ (DoD) vision for scaling digital data analytics and AI to ensure decision advantage for war fighting. In November, the DoD released is initial strategy geared towards accelerating the adoption of artificial intelligence capabilities including the development of technologies for:

Superior battlespace awareness and understanding

Adaptive force planning and application

Fast, precise and resilient kill chains

Resilient sustainment support

Efficient enterprise business operations

Source: DoD

The blueprint also trains the focus of the department on several data, analytics and AI-related goals:

Invest in interoperable, federated infrastructure

Advance the data, analytics and AI ecosystem

Expand digital talent management

Improve foundational data management

Deliver capabilities for the enterprise business and joint warfighting impact

Strengthen governance and remove policy barriers

Taken together, these goals will support the "DOD AI Hierarchy of Needs" which the strategy defines as: quality data, governance, insightful analytics and metrics, assurance and responsible AI. (Source: US DoD)

Insider Activity

Credo’s (CRDO) COO, Lam Yat Tung has been selling stock steadily for the past several months, over 30% of their position. The CTO has also sold over 30%, with the CEO selling approximately 20% over the same time span. The stock dropped from around $17.00 at the beginning of 2023 to a low of $7.20 in May and a rebound to its recent high of $23.18, so it’s possible that all of the executives are taking profits after watching millions slip away between January and May of 2023. While we want to give them the benefit of the doubt, the constant sales are still quite disconcerting.

Not shown above, given that we didn’t want one company to dominate all of the available slots, is Entegris (ENTG). It’s Chief commercial Officer shed 54% of his position, the SVP of HR sold 28% of her position, the President of the APS Division sold 22%, the President of the MC Division sold 33%, among other smaller sales by other insiders.

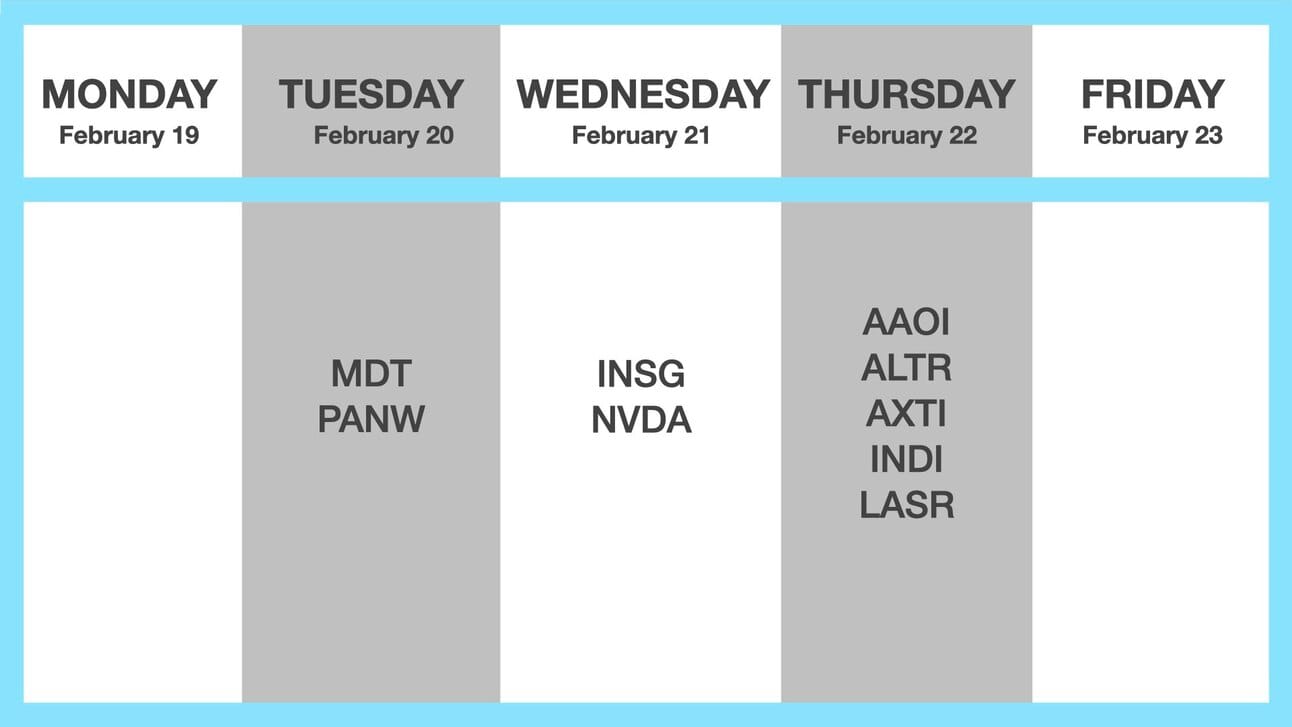

Earnings Calendar

FYI - The author purchased shares of INTC after the January 6, 2024 newsletter and currently holds a small position.